WEEKLY FED WATCH

This week on Fed Watch, Lauren Saidel-Baker takes a closer look at US consumer health. Headlines about record-high credit card debt tell only part of the story. The reality is more complex. We unpack what really matters for households, businesses, and the Fed as the cycle evolves.

Key Episode Takeaways

- 00:01 – Introduction to consumer health focus

- 00:57 – Misconceptions about record-high credit card debt

- 02:08 – Debt-to-earnings ratios as a better measure

- 02:59 – Delinquency rates and payment behaviors

- 05:06 – Mortgage and auto loan delinquencies

- 05:47 – Fed considerations and takeaways

The below transcript is a literal translation of the podcast audio that has been machine generated by Notta.

Hi, I’m Lauren Saidel-Baker, and thank you so much for joining me for this September 26th edition of Fed Watch. Today, let’s take a slightly different approach to looking at the data, and specifically, I wanted to address the US consumer. The Fed is starting to show some signs of concern, especially as it regards the labor market, but really watching consumer health and consumer spending patterns to see, are they holding up this cycle? Now, one of the biggest points that we hear made is with regard to consumer credit, consumer borrowing, and certainly those delinquency rates. Now, anytime we talk about this on a consumer basis, we really get echoes of 2008. We know those keywords to watch out for, the bad debt, the over leverage in terms of the US consumer, so I wanted to really delve into a couple of those data points today.

The first one is just with regards to how much credit card debt we’re taking. This is one of the biggest headlines that I hear almost every time the data is released, the headlines come screaming, “US credit card debt is at a record high,” and they queue up these very concerning news stories as if that’s a bad thing, as if too much credit card debt means our consumer is perching themselves on the edge of a cliff and just waiting to topple off. So let’s look at what actually goes into that number, because I think this headline is so misleading.

Consumer credit card debt is almost always at a record high, first of all, because we have rising prices. So positive inflation, that means the same basket of goods if put on a credit card, makes for a higher balance today than it has in years past. But the other factor to consider is that we have positive population growth, at least thus far. And so we have more credit card accounts, more consumers out there to hold more individual credit card accounts, and the actual level of credit card debt in each credit card account, well, that is pretty meaningless if you just look at the sum total of how much debt is out there.

So I prefer to look at this measure in terms of the consumer’s ability to service that debt. One way to do that is to look at it as a share of their earnings. And today, US credit card debt per household as a share of median annual earnings is right about 14.6%. This is nowhere near the 20% levels that we saw in the run-up to the 2007 to 2008 recession. It is a little bit more elevated than say in the depths of the pandemic when a lot of individuals got that stimulus money and they paid down their high APR credit card debt first. So we’re slipping back into some old habits since 2020, but this rate of credit card debt as a share of our earnings, this is about as good as things got during that last decade between 2008 leading right up to the COVID pandemic.

So let’s look at this a few different ways. If we’re looking at not just the sum total of the debt or our ability overall to service that debt, let’s drill down into what consumers are actually doing with this debt. One of the ways we can do that is through the delinquency rate. And the mid 2025 consumer credit card delinquency rate came in at 2.87%, that’s actually the lowest level this has been since the second quarter of 2023. So to say that things are getting materially worse more recently, I think that is a little bit misleading.

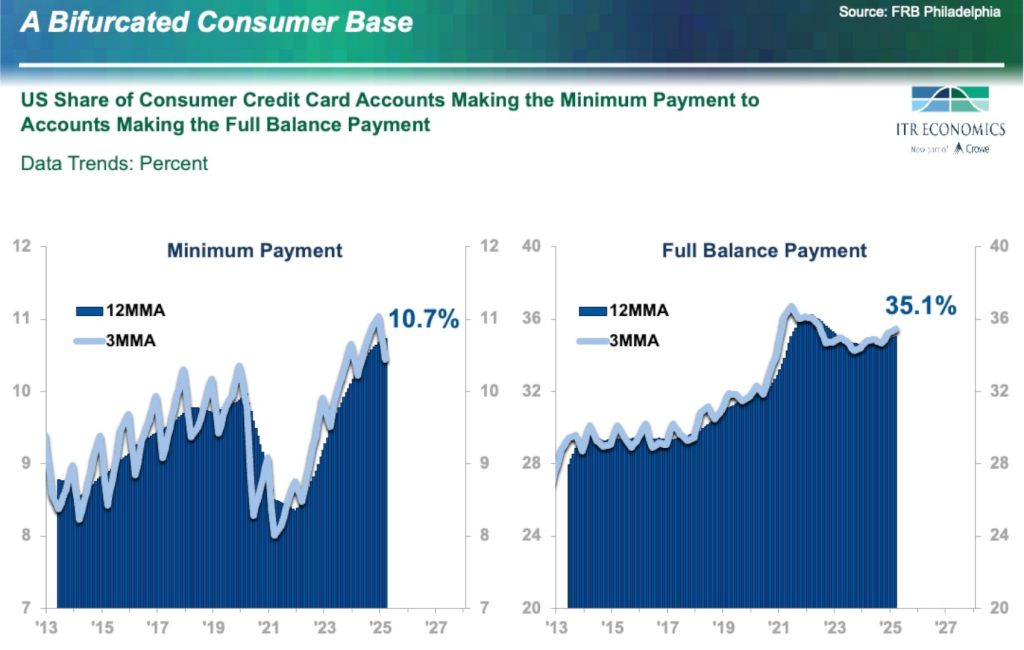

Where we are starting to see some movement though, is if you look at different cohorts of our income distribution. So I don’t usually do this, but I have a chart that I wanted to show you today. And this is showing the share of our US consumer credit card accounts that are making either just the minimum payment month to month, or that are paying their full balance each month as it comes due. Those only the making the minimum payment, that number is creeping up, the share of folks who are just getting by with what they have to pay month in and month out. That’s now topped 10% of total credit card accounts. And I know this line looks quite elevated. We don’t have data all the way back to 2006 2007. Our data trend you can see here starts in 2013. So we’re really only looking at a comparison of better consumer outcomes, somewhat more normal, more recent consumer outcomes here. But let’s look at the other side, the right hand of this chart. That’s where we see those accounts paying their full balance every month. That’s actually creeping up too. It’s not as stark of a rise as that minimum payment chart is, but this is above 35% right now, so more than a third of our credit holders are making their full payment. The difference between these two, there’s some middle portion that’s making a partial payments. So that gap is shrinking that middle kind of cohort here, that’s getting a little bit squeezed as we see the bottom come up at the top come down.

So what does this mean for the US consumer? Well, we can follow this data in a number of different ways. I’ve given you several of the key metrics that we’d like to follow. We can also watch things like residential mortgage delinquencies. Those are still at a very healthy level. Credit card delinquencies overall, I’m seeing this back on trend, really not too concerning yet. The one canary in the coal mine right now is auto loan delinquencies. Those are creeping up 4.99% is the most recent reading. Our post-great recession but pre-COVID average was 4.1%. So on the auto side, these delinquencies are slightly elevated but really not in worrisome territory quite yet.

So as the Fed is looking at all of this data, they’re seeing, yes, a bifurcated consumer base, they’re seeing that divergence in the very low and very upper income cohorts. But at the end of the day, we have to just question, we can’t rule out the consumer doing something different this time around than how they usually behave. I know we’re getting a lot of sentiment surveys. Keep in mind, those are not the most compelling leading indicator for these real outcomes in terms of retail spending or other key fundamental drivers.

So as I’m watching these delinquency rates and our consumer health in general, this is still something to watch, but nowhere near something to worry about. As the labor market side of the Fed’s dual mandate ties into these drivers, we are still seeing those upside wage pressures. These are all factors the Fed will be considering going forward, and we hope you’ll consider them as well. Until next time, we’ll see you right here on ITR Economics, Fed Watch. Take care.